Small online retailers pay charges of up to four percent for each transaction. I mentioned this because you used the term card companies which might be interpreted a variety of different ways.

Credit Card Companies 15 Largest Issuers 2020 List Cardrates Com

Learn about the main revenue generators and how you can pay the companies a lot less and even make money off your cards.

How much do credit card companies make per transaction. The primary way that banks make money is interest from credit card accounts. Debit cards are the least expensive to the merchant. How do credit card networks make money.

These are the companies that create credit cards like visa mastercard and american express. How much are credit card processing fees. Credit card companies are raking in gobs of dollars in fees.

How much do credit card companies make per user. Every banking or credit card institution has their own set of fees. Average credit card processing fees.

Income from credit card interest and merchant fees. Large online retailers negotiate credit card charges of two percent or less per transaction. Thats because the credit card company issuer and processor all get a chunk of the total per transaction fee and each of those companies charges a different rate per transaction.

Interest fees charged to cardholders and transaction fees paid by businesses that accept credit cards. Compare the flat fee companies to the interchange plus companies on a per transaction as well as monthly basis. If youre looking for quick numbers here you go.

So what do businesses pay for credit card transactions. They set all the rules. Visa and mastercard are next but it.

The credit card companies justify the higher charges because of the greater risk of financial fraud with online sales. Only then will you be able to make the decision that works best for your companys bottom line. When a cardholder fails to repay their entire balance in a given month interest fees are charged to the account.

The average credit card processing cost for a retail business where cards are swiped is roughly 195 2 for visa mastercard and discover transactions. Merchant fees hurt small business but the companies that process these cards dont care. My point being that these com.

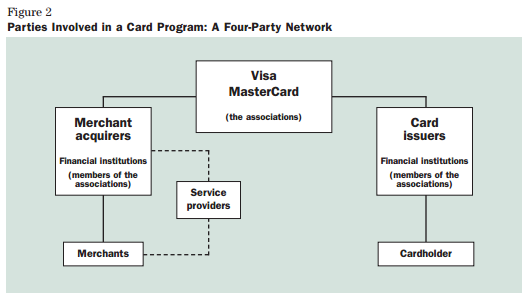

Credit card companies make the bulk of their money from three things. Its important to understand that the companies youve mentioned are card networks not card issuers. The question of how much a retailer must pay a credit card company per transaction is a complicated one.

The per transaction card brand fees however apply to all transactions be they sales or refunds.

How Apple Pay And Google Wallet Actually Work Ars Technica

Credit Card Processing All You Need To Know About Card Payments

4 Ways Your Global Customers Can Pay You Directly Payoneer Blog

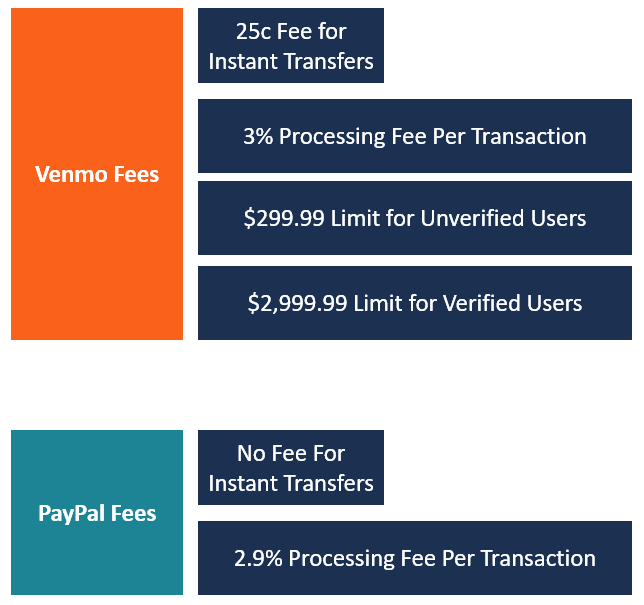

Venmo Overview How It Works Fees And Transaction Limits

Largest Credit Card Processing Companies Merchants In 2020

Interactions Between Various Parties In Credit Card Transactions

2 Methods How To Get Cash From A Credit Card

The Best Way To Use A Credit Card Treat It Like Cash The New

No comments:

Post a Comment