Transfer the money to an e wallet from the credit card you want to make the payment with. The most popular service is called plastiq.

Citi Introduces Payall Enabling Credit Card Payments For Rent And

But the best time to make a credit card payment may be whenever your credit utilization ratio exceeds 30.

How can i make a credit card payment. Paying at least part of your bill before the closing date could be even better if you want a good credit score. In the big picture this doesnt make for smart financial planning. In todays high tech world it is very simple to make a payment by credit card.

Simply walk in to the respective bank branch fill in the deposit slip with your credit card details and the bill amount and submit it at the counter. The institution financing your vehicle is charging you interest and the credit card company is charging it as well. If your credit card issuer is a bank with a physical office you can walk in to the nearest branch and make your credit card payment by depositing cash.

If you use a credit card to make a car payment youre essentially paying interest on top of interest. When you cant make your monthly credit card payment the absolute worst thing you can do is just let the bill go unpaid. Use the e wallet to pay the amount.

It allows you to make payments on a variety of bills including your student loans mortgage and rent with a credit card. Skipping your minimum payment will only make it harder to catch up and youll have to deal with some not so pleasant consequences. How to make your mortgage payment by credit card.

Credit card payments can be made via the internet over the telephone or you can still use your credit card to make payments via regular post if you dont have internet access. Since most lenders wont let you charge your mortgage to a credit card youll have to use a third party payment service. Youll be in good shape if you can pay off your credit card by the due date especially if you pay your entire balance.

High credit card balances increase your credit utilization and hurt your credit score. Keeping your balances low shows that you can handle credit responsibly and will help improve your credit score. This is another way of paying one credit cards bill through another.

A good rule of thumb is to keep the total of your balances to no more than 30 of your combined credit limits. You could transfer your balance to another credit card and pay the bills on your other credit card.

3 Ways To Make An Aarp Credit Card Payment Wikihow

How Do I Pay My Standard Chartered Credit Card Bill Online Quick

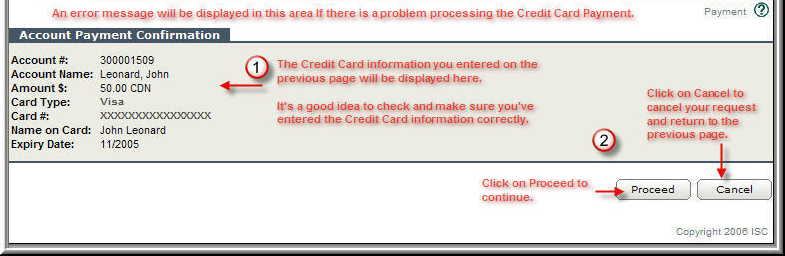

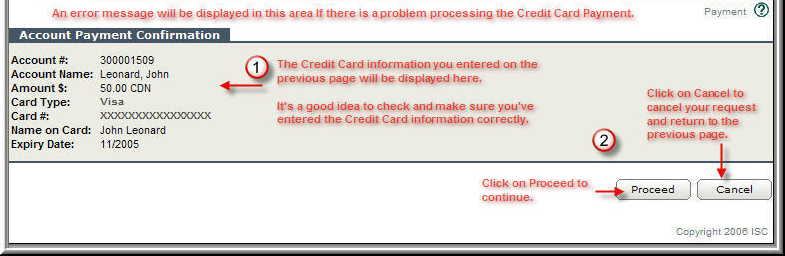

Isc Adding Funds To An Account By Credit Card

How To Use Paypal To Accept Credit Card Payments 6 Steps

Goodbudget Credit Card Payments

Credit Card Basics On Mobile Ynab Help

What Happens When You Swipe A Card On A Terminal

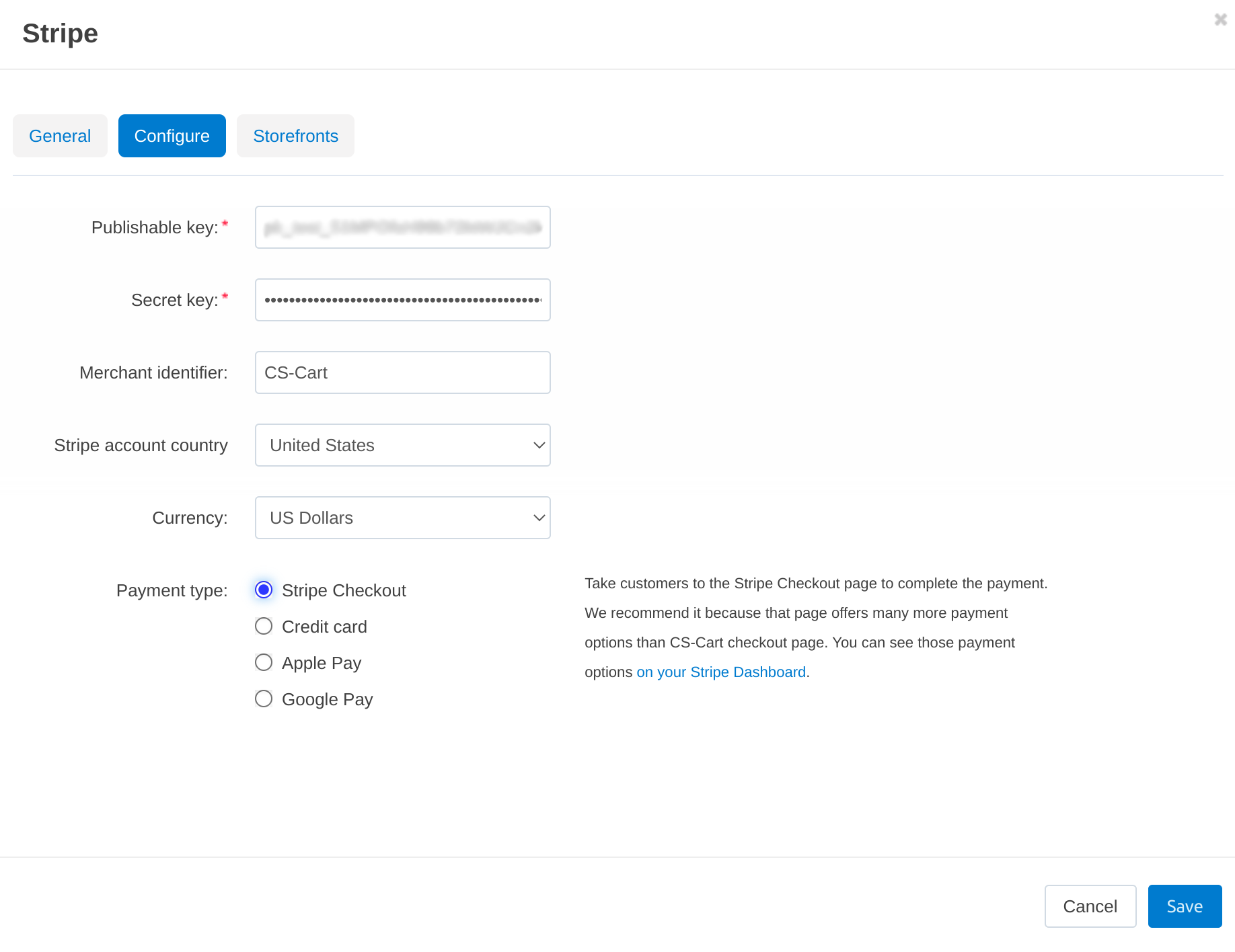

How To Set Up The Credit Card Offline Payment Method Cs Cart

How To Set Up Apple Pay Google Pay And Credit Card Payments Via

No comments:

Post a Comment