If you transfer balances from multiple credit cards to one balance transfer card this can streamline your payments into one easier to manage payment. Its a marketing tool the credit card industry is.

/cdn.vox-cdn.com/uploads/chorus_image/image/63308691/Apple_Card_hand_iPhoneXS_payment_032519_big.jpg.large.4.jpg)

Everything We Know So Far About How The Apple Card Works The Verge

As we know your monthly payment we can work out how many months it would take you to repay the original balance.

How do credit card companies make money on balance transfers. Its possible to be denied if youre requesting a balance transfer for a larger amount than your credit card company allows. Interest fees charged to cardholders and transaction fees paid by businesses that accept credit cards. Credit card balance transfers are tools that many people choose to utilize at some point.

Balance transfers work by literally shifting your debt from one credit card to another. A balance transfer credit card is the tool that you use to do this. The balance of your old card is paid off by your new card effectively swapping who you have to repay.

This will change if you alter your monthly payment or add any extra spending or balance transfers to the card. Consumers who opt for a 0 transfer should understand that the interest free period is only. Banks can limit balance transfer requests to a set dollar amount or percentage of your new credit line.

The cost also takes into account any cashback you may get from the credit card company as money off your total balance. Some balance transfer cards offer a 0 intro apr for balance transfers for a limited amount of time. While balance transfers can be helpful in the debt payoff process theyre not a magic solution.

If you have debt on a credit card at a typical interest rate of 18 it could quickly. Here are the basics of how to make money off of credit card balance transfers. Also consider that virtually every time you apply for a new credit account including a balance transfer credit card the lender will run a hard inquiry on one or more credit reports.

Each new hard inquiry usually dings between five and 10 points off your credit score. Credit card balance transfers are typically used by consumers who want to move the amount. Well explain how credit card companies hope to profit from 0 apr credit cards and how you can make sure to use them to your advantage.

Usaa for example caps balance transfers at 95 percent of the balance transfer cards credit limit. Moving outstanding debt on one credit card to another cardusually a new oneis a balance transfer. While many people use transfers to eliminate interest charges certain individuals use them as a way to make money.

Credit card companies make money not only from interest but also from merchants when purchases are made. Credit card companies make the bulk of their money from three things. Do balance transfers hurt your credit score.

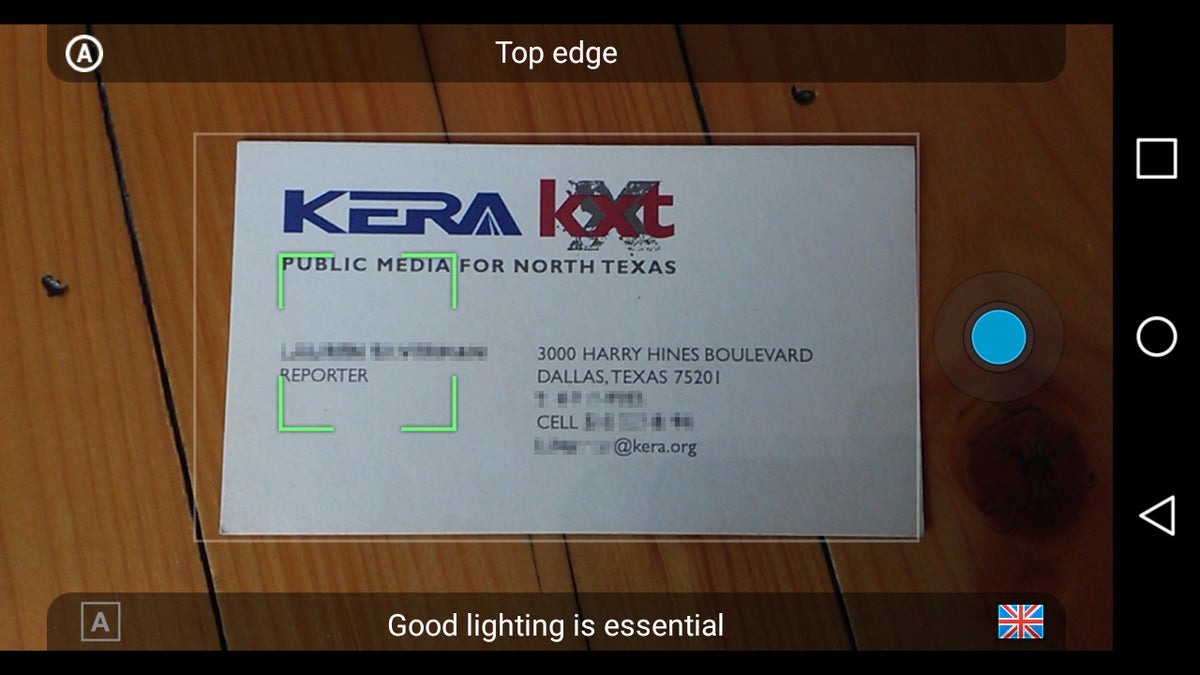

Zero Interest Balance Transfer Card Offers Discover

8eaeiwzhablqvm

How Do Credit Card Companies Make Money Money Under 30

How Minimum Payments And Credit Card Interest Are Calculated

How Does Credit Card Interest Work Daveramsey Com

Zuuapl8podkcxm

Credit Card With Balance Transfer Offer Citi Simplicity Citi Com

How Credit Card Balance Transfers Work Credit Card Insider

How To Read Your Credit Card Statement

/stacked-credit-cards-480920118-00ee729e90f544cb8fdb3e246effb2bc.jpg)

![]()

:max_bytes(150000):strip_icc()/study-library-students-576c41c65f9b5858756abfa0.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/63308691/Apple_Card_hand_iPhoneXS_payment_032519_big.jpg.large.4.jpg)